Whether you are an SAP consultant or a regular SAP user, it is common to make payments to suppliers or carry out tests on this process. However, it may sometimes happen that the invoice is not taken into account or is not eligible for payment, for various reasons. Even if you make every effort, it can be difficult to determine the underlying cause of the problem, even when the invoice is correctly recorded.

In the following sections, we highlight the recurring errors that hinder the smooth integration of the invoice into the F110 process and their causes.

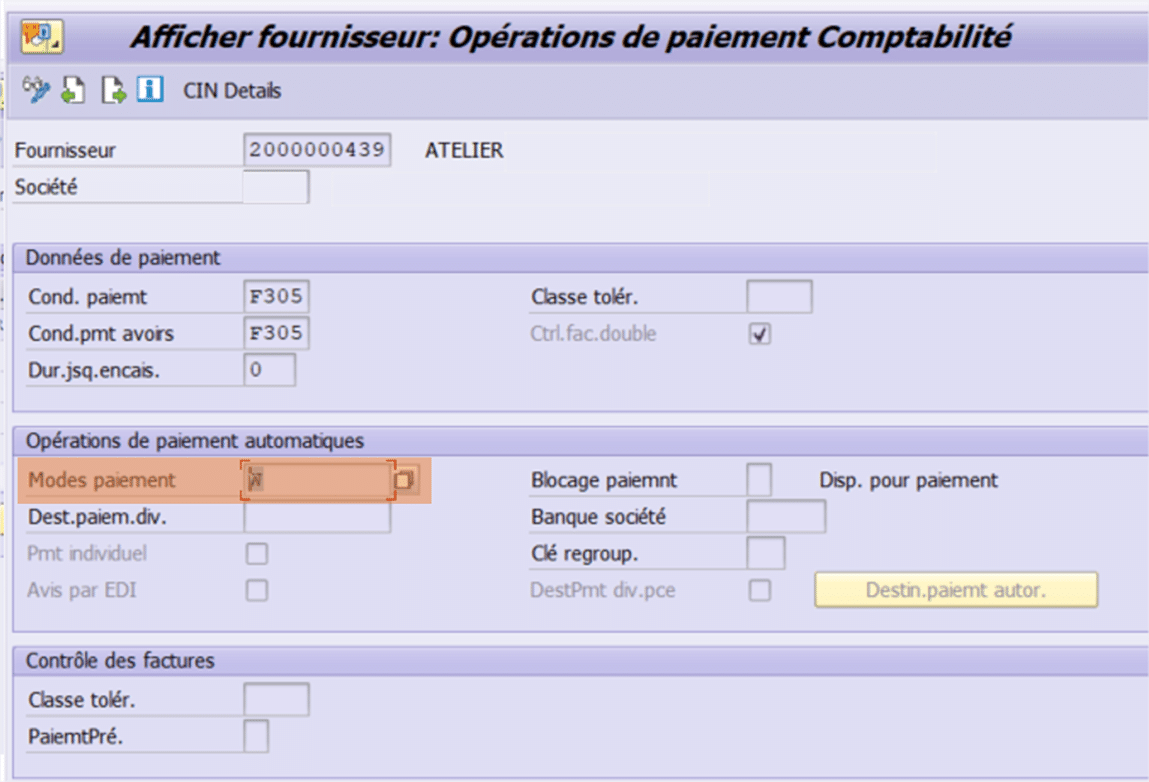

Missing payment method

Always check that the supplier file contains an appropriate payment method, in our case, a payment method for making transfers. and also check the presence of this mode at the invoice level.

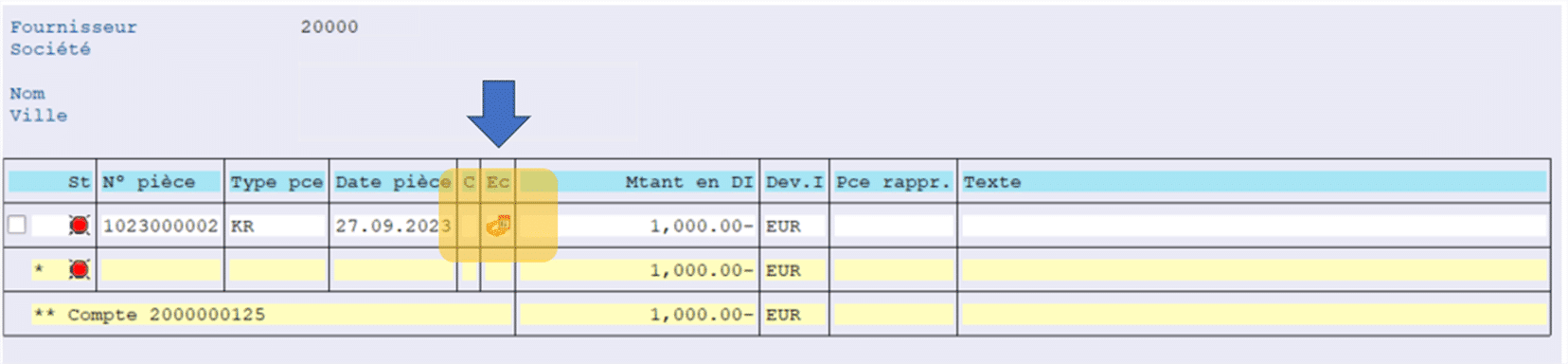

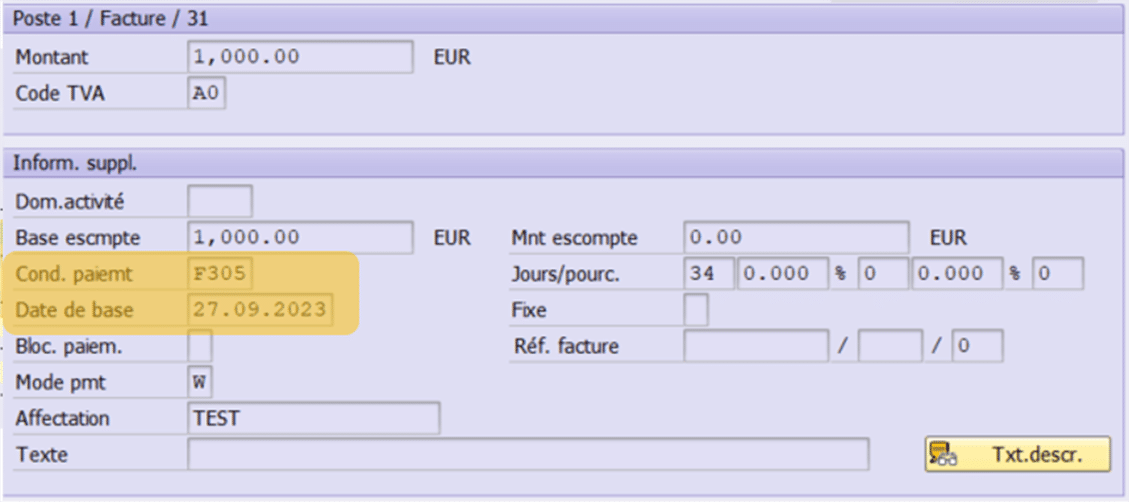

The invoice is not due

Carefully check the due date of the invoice to be sure that it is due.

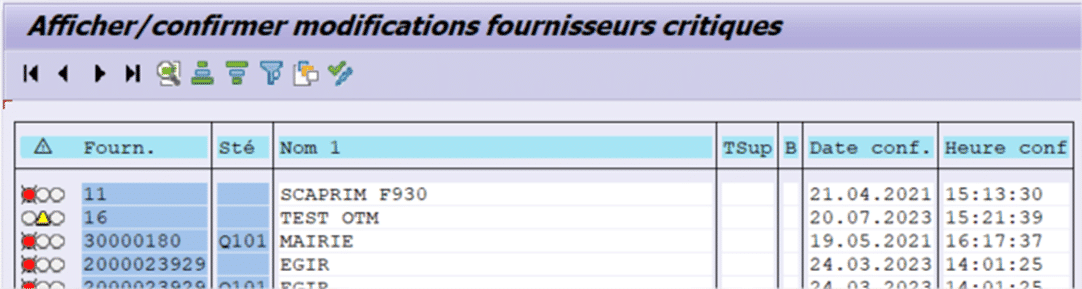

The supplier sheet has not yet been confirmed

Sometimes, the creation or modification of the supplier record may be subject to approval by another accounting department, thus involving two different users, as in the case of the validation of bank details by the financial department. When the supplier record has not yet been validated in this situation, all invoices linked to this supplier cannot be processed for payment.

In this scenario, you have two options:

- Either you can request confirmation from the competent department,

- otherwise in the case of a test or recipe environment, you can use transaction FK09 or directly make changes to the value in debug mode at the appropriate table level (reserved for insiders – SAP Expert).

Example :

T-code FK09 (List of bank details awaiting validation)

The supplier and the invoice are already linked to another payment proposal

If the supplier is already associated with a payment proposal which has not yet been recorded in the accounts, it then becomes impossible to use it simultaneously in a second payment cycle.

In this case, you will have two options:

- Either delete the previous payment cycle

- Otherwise, proceed to its accounting recording.

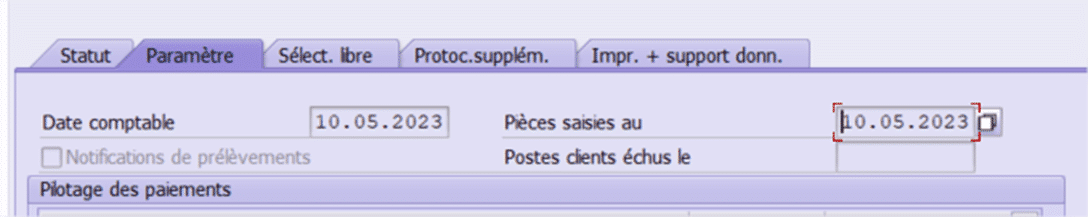

Entry date less than the invoice creation date

For example, if a supplier invoice was created on 05/11/2023, it is then logical that the invoice is not taken into account if the date of the document entered is earlier, i.e. 05/10/2023.

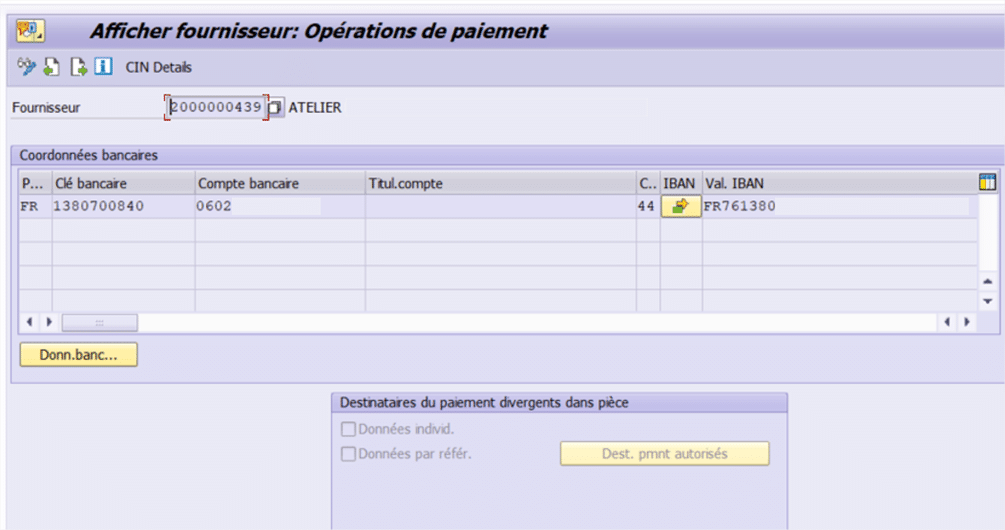

No payment transaction has been defined at the third party level

You never know, but make sure that the supplier’s bank details are present.

If you find yourself facing this type of problem, do not hesitate to contact us so that we can help you and advise you on the options available to you.

Rabah Selami

With more than 12 years of experience in the field of finance via SAP, I have acquired extensive know-how in multi-domain functional SAP integration as well as expertise in application maintenance (TMA) under SAP ECC and SAP HANA.

My versatile expertise allows me to quickly solve complex problems and provide fun and, above all, operational training to SAP consultants and users.